Discover 6 Simple Ways To Raise Funds For Your Business

When it comes to raising funds for your business, the process can feel daunting and overwhelming.

Like a lot of entrepreneurs, my understanding of investments was limited to what I had seen on TV shows like Dragon’s Den.

But when I realised that raising funds is a crucial step in driving business growth, everything changed. I put some serious effort in. Spoke to hundreds of investors and investment bankers, and read every book I could get my hands on. I picked up SO MUCH in such a short space of time. Let me share my personal journey and shed some light on how you can raise funds for your business.

My Personal Background And The Initial Questions I Had On How To Raise Funds For Business

I did not grow up in the world of investment banking. Far from it! No one in my family even had business experience. My parents both lived in council houses.

Business matters were entirely foreign to them.

And I had to navigate the world of fundraising with limited guidance.

It all started when I started a huge project that needed investment.

But I had a few questions that hit me straight away when I thought about raising funds.

Would we lose control of our business? What are investors trying to achieve? I needed answers to make an informed decision.

Importance of Accountability, Support, Speed, and Added Value

-

Being Accountable to Someone

As an entrepreneur, the freedom and control over your business is exhilarating. But having someone to hold you accountable can be a powerful motivator. It’s a bit like having a personal trainer at the gym. Being responsible to someone can push you to give your best every day.

-

The Power of Support

Starting a business can come with a lack of experience running a large company. Surrounding yourself with experienced individuals can prove invaluable. Their guidance and support helped us make informed decisions and navigate the challenges that arose.

-

Speeding Up Business Growth

Entrepreneurs often have ambitious visions and goals. But turning those dreams into reality requires time, energy, and, most importantly, money. Raising funds from the right investors allowed us to achieve our goals more quickly. In a competitive market, being the first mover can provide a significant advantage. And securing funds helped us stay ahead.

-

Added Value for Scaling

In the early stages of our business, we had limited resources. No office, marketing, website, or financial support. The first investment we received provided us with added services and support that helped us build the business. With these foundations in place, we were able to focus on scaling.

The Ongoing Value of Raising Money for Business Growth

The lessons I learned from my initial experience are still true. Raising money is not just about the capital.

It’s about finding partners who share your vision.

And can provide the support and resources you need.

It’s about leveraging the expertise and networks of investors to fuel your business growth.

Raising money will always present challenges for founders. Often juggling between day-to-day business operations and pitching to investors.

It’s essential for founders to focus their time and energy on areas that have the most significant impact on their business. That’s where the value of partnering with the right investors comes into play.

You should understand the demands founders face and strive to ensure that you can focus on growing your business.

Through this article, we’ll explore six simple ways to raise funds for your business.

From traditional options like banks and grants to alternative avenues like angel investors, venture capitalists, and crowdfunding.

You will get fresh insights and strategies that you need to navigate the fundraising landscape successfully.

Where to Find the Money

Starting with Personal Funds and Friends/Family

When you’re first starting out, your own personal funds and contributions from friends and family may be the only funding options available. It’s a common and accessible way to get your business off the ground. But, it’s important to consider whether the funds from friends or family will be treated as debt or equity.

Debt means you loan the money and repay it over time.

Equity means you give them shares in the company. So they become shareholders or part owners.

The downside to this strategy is the amount of cash that you can get your hands on. It’s normally pretty limited when you go down this route.

Exploring Options with Banks and Understanding Collateral Requirements

Banks can be a viable option for raising funds. But they usually require collateral. Things like personal or business assets (assets are things that you own, such as property or other cash you might have).

It helps secure the loan.

Building a relationship with a bank before applying for a loan can work in your favor. They’ll want to see your current assets. And they may ask for a Cash Flow Forecast (CFF) to assess your financial stability.

Banks will often ask for you to be a personal guarantor. This means if the business fails, you still owe the money.

How To Raise Funds For Business – Loan

SBICs (Small Business Investment Companies) and Their Role in Funding

SBICs are privately owned and managed investment funds. They are licensed and regulated by the Small Business Administration (SBA). SBICs use their own capital, along with funds borrowed with an SBA guarantee. They are there to make equity investments and provide loans to qualifying small businesses. SBICs can be a valuable funding option, especially if your business meets its criteria.

Grants and Their Limitations, Specific Criteria, and Repayment Options

Grants are an attractive option for many entrepreneurs because many of them don’t have to be repaid. However, they are often limited and highly competitive. Grants are usually specific in terms of sector or geography.

Because of that it’s essential to research and identify grant programs that align with your business. Be prepared to meet specific criteria and follow any reporting or accountability requirements.

Angel Investors as a Valuable Resource with Expertise and Networks

Angel investors are wealthy people who invest in businesses. Typically they can invest for both equity and debt.

They often operate individually but can also pool their resources with other angels.

What sets angel investors apart is the additional value they bring.

They have firsthand experience and can provide mentorship, guidance, and valuable connections. Their ability to make quick decisions can expedite the funding process. It’s much quicker to find and work with an angel than it is with a venture capital firm.

Raise Funds For Business – Angel Investors

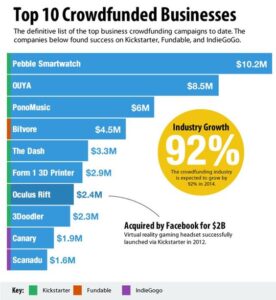

Crowdfunding: Marketing, Sales, and Investment All in One

Crowdfunding has gained popularity as a means of raising funds while simultaneously marketing and selling your product or service.

There are different types of crowdfunding campaigns.

You could work on a donation-based, pre-sale, or equity-based model. Each approach has its unique benefits and considerations.

Utilising social media and other platforms can help build credibility with potential backers and generate interest in your campaign.

Raise Funds For Business – Crowdfunding

Venture Capitalists and Private Equity Groups for Larger-Scale Investments

Venture capitalists (VCs) and private equity (PE) groups specialise in investing other people’s money into high-potential businesses.

VCs primarily focus on equity investments.

PE groups use funds from various investors, including private foundations, pension plans, and university capital funds, to invest in established companies.

These types of investments often involve larger amounts of capital and come with additional guidance and support.

There are lots of different options

When it comes to raising funds for your business, the options are varied and wide-ranging. It’s so important to understand the requirements and implications of each option.

You should also consider the specific risks investors worry about. Things like the market, financial, management, product, execution, and competitive risks. Remember, investors are looking for a substantial return on their investment, aiming for two, three, or even five times their initial investment.

The first funding round may be the most challenging and time-consuming, but building a strong network and connections can make the process smoother in the future. Always evaluate whether the growth you can achieve with the funds raised outweighs the equity you have to give away. During the due diligence process, be prepared, honest, and open to ensure that your business matches the expectations you’ve set.

Treat Investors as Customers and Understand Their Preferences When You Raise Funds For Your Business

When you’re pitching to investors, think of them as customers you need to impress. Like customers, investors have their preferences and priorities.

Do your homework and understand what they’re looking for in an investment.

Tailor your pitch to showcase how your business aligns with their interests.

Remember, it’s not just about your business, it’s about fulfilling their needs too.

Address Investors’ Concerns and Provide an Exit Strategy

Investors are naturally concerned about the risks associated with investing in your business. Address these concerns head-on. Be transparent about the potential risks and how you plan to mitigate them.

Also, don’t forget to discuss the exit strategy.

Investors want to know how they can cash out and make a profit. Have a well-thought-out business plan for providing them with a return on their investment.

The Six Risks Investors Consider: Market, Financial, Management, Product, Execution, and Competitive Risks

Investors are risk-averse creatures. They want to make sure they’re not throwing their hard-earned money down the drain.

So, what risks are they concerned about?

Well, there are six main ones:

The Market, financials, management, the product, execution, and competitive risks.

Take the time to analyse each of these risks and develop strategies to overcome them. Show investors that you’ve got a handle on these challenges.

But don’t deny risk and try to convince them there isn’t any.

Investor Expectations: Seeking Returns Beyond a Mere 6%

Investors don’t just want a small return on their investment. They’re aiming for something more substantial. We’re talking returns that go beyond a measly 6%.

Investors are taking risks, and they expect to be rewarded for it. When you’re raising funds, make sure your business plan demonstrates the potential for significant returns. Show them the money, baby!

The Challenging Nature of the First Funding Round and Building Networks

Let’s not sugarcoat it. The first funding round can be tough as nails.

It takes time, effort, and a whole lot of networking.

Building relationships with potential investors is crucial, and it doesn’t happen overnight.

Attend industry events, join entrepreneurial communities, and put yourself out there.

You never know who might become your next big supporter. Building a strong network can make the fundraising journey a little less bumpy.

Evaluating the Worth of Giving Away Equity for Potential Growth

When you’re raising funds, you might be asked to give away a slice of your precious equity. That means giving away shares in exchange for cash. It’s a tough decision.

You need to evaluate whether the potential growth you can achieve with those funds outweighs the equity you’re giving away.

Do the math, consider the long-term benefits, and make an informed decision.

It’s like weighing the pros and cons of eating that extra slice of pizza. Sometimes, it’s totally worth it.

The Importance of Honesty and Openness During Due Diligence

During the due diligence process, honesty is the best policy. Be open, transparent, and genuine with potential investors.

They’ll appreciate your authenticity.

Don’t try to hide any skeletons in your closet. It’s better to address them upfront.

Honesty builds trust, and trust is the foundation of any successful relationship. Whether it’s personal or business-related.

Summary – How To Raise Funds For Business

We’ve covered some simple yet powerful ways to raise funds for your business.

Remember, you have options.

Personal funds, friends and family, banks, SBICs, grants, angel investors, crowdfunding, venture capitalists, and private equity groups.

All of them have strengths.

Grants for example don’t normally need to be repaid.

But they also have weaknesses.

Grants are super competitive. It’s a tough market to crack.

Explore these avenues, find the one that fits your business like a glove, and go for it.

Don’t forget the value of support and mentorship throughout this fundraising journey.

Surround yourself with experienced people who can guide you and share their wisdom.

They’ve been there, done that, and can offer insights that will help you navigate the fundraising maze.

Lastly, focus on growing your business while managing your funds.

It’s a delicate balance, but with the right mindset and strategy, you can conquer it.

Go out there, chase those funds, and turn your business dreams into reality. You’ve got this.