Assets for your balance sheet: Simply explained with 3 easy to use tips

-

Pick up the phone and call me.

-

Throw this article straight into the bin.

She said “The advice you gave me was, without question, the telling difference between success and failure of our clothing business. Truly brilliant stuff.”

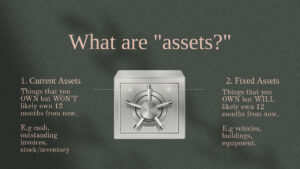

What are assets?

What are assets?

What is the balance sheet for?

Assets for the balance sheet

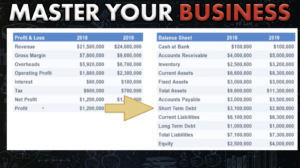

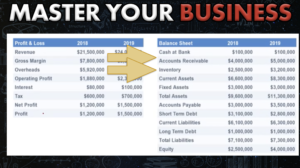

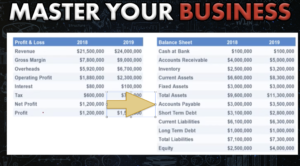

Take a look at the Profit and Loss on the left-hand side.

In 2019 this company made £1.5 million in Net Profit (that means profit after tax).

But in the same year, over on the balance sheet (right-hand side), you’ll notice something strange.

The cash at bank (or bank balance) has stayed the same.

So where has the £1.5 million gone?

Here’s what’s scary.

Almost every business we’ve ever gone through a balance sheet with, has the same problem.

They don’t know why the profit hasn’t translated into cash.

And here’s an even bigger problem.

There are two main types of accounting systems.

A cash system, or an accrual system. (An accrual system means that you pay tax when you invoice someone, rather than when the cash hits the bank).

If you are on an accrual system (which lots of small businesses are) you have to pay TAX ON THE PROFIT.

Yes, that’s right.

Tax on the profit that you don’t even have the cash for.

So with the example above, they’ve done a great job making profit.

But an awful job turning that profit into cash.

And now they have to pay tax.

And their bank balance isn’t big enough to pay it.

They’d better get a move on.

And quick.

Which is why they called their business coach.

And asked them the question.

“Where has the money gone?”

There are a few different places that it could have gone.

First, there’s:

Debt.

If the company has taken on debt, you may use profits to repay the debt.

That can result in a decrease in liabilities (which means things you OWE).

Which is still helpful.

Then there is:

Retained earnings.

Property, Plant, and Equipment (PP&E).

Other assets.

Paid as dividends.

Debt changed on the balance sheet

It’s lost.

Working capital.

Accounts receivable.

Accounts payable.

INVENTORY (a posh word for your stock).

Where did the £1.5 million go?

Now you’ll be able to find it much easier.

We already spotted the £300,000 that reduced debt.

Now we just need to find £1.2 million.

So take a look below at the area’s of working capital that we discussed.

Let’s start with accounts receivable (outstanding invoices) and inventory (stock).

Assets on the balance sheet

Liabilities on the balance sheet

Now, as the owner or CEO of the business.

You know how to find the cash that’s held up in the balance sheet.

You’ll also understand what we use a balance sheet for.

All that’s left, is to understand the terms.

If you can figure out what the language on a balance sheet means, it’s so much easier to read.

So here goes.

Definition of the things that sit on a balance sheet

Here’s the funny thing.

A balance sheet would be really easy to read if the language was simplified.

So here are all the items that sit on a balance sheet, with a translation.

That way you can understand how to read a balance sheet and why it’s so important.

Cash at bank

Your bank balance. Simple one to start us off.

Accounts Receivable

Your outstanding invoices. Your bookkeeper should move the work here once you’ve raised an invoice.

Inventory

Stock. This shows how much stock and materials you are holding. It’s important to do a regular stock count to make sure this figure is accurate. Ideally once a month.

Work In Progress

Jobs that you are working on, that aren’t finished. When you finish them and raise the invoice, they move out of work in progress and into accounts receivable. Most companies have to record these manually. They won’t automatically show up on your accounting software. So if you want an accurate balance sheet, you’ll need to ask your bookkeeper to add it manually most of the time.

Current Assets

Things that you OWN, but won’t do in 12 months. Things like cash, outstanding invoices, and stock fit here.

Fixed Assets

Things that you OWN, and will still own in 12 months. Things like property, vehicles, and other business investments sit here.

Total Assets

Simply add your current and fixed assets together.

Short Term Debt

Loans that are current and need paying in the next 12 months. Often if you have a large loan that has a longer repayment schedule than 12 months, your accountant would calculate how much of the loan you will pay in the next 12 months and that would go here.

Accounts Payable

Outstanding invoices. These are the invoices that your suppliers have sent to you and that are waiting to be paid.

Current Liabilities

It’s the result of your short-term debt and accounts payable. It’s the debt that you owe that will likely not be debt in 12 months.

Long Term Debt

Debt that WILL still be due to repay in more than 12 months. Usually bank loans.

Long Term Liabilities

All of your long-term liabilities are added together. Anything that’s longer than 12 months.

Total Liabilities

Add up your current liabilities and long term liabilities to get this number.

Equity

Just like working out the equity in your personal property or family home. You work out what the assets are worth (the house).

Then you work out the liability or debt (the mortgage).

And calculate the difference.

So if you have a house worth £750,000 and the mortgage is £250,000, you have equity of £500,000.

It works the same on your balance sheet, work out the assets, minus the liabilities and you’ll have your equity figure.

Your equity should be the same as the equity you had last year plus the amount of profit you made in the same period.

So if you had £1,000,000 in equity on the balance sheet last year.

Then you make £500,000 in profit this year.

Your new equity number should be £1,500,000.

That way, the profit and loss statement, and the balance sheet, both BALANCE.

Summary

Now that you know what assets are.

And what a balance sheet is for.

You can finally use it to get some of that cash out of the balance sheet and into your bank account.

But it’s important that you review your balance sheet each month.

Check to see whether the amount of cash being held in “working capital” is climbing or not.

If it is climbing, you need to pull your figure out and take action.

Start chasing the outstanding invoices.

Reduce the stock.

Get the work completed so you have less tied up in “work in progress.”

And then, you might even be able to book yourself a holiday.

Or re-invest some cash back into the business.

Maybe it’s time to pay yourself more.

Either way, you deserve all the success that a profitable business can bring.

So go get ’em team.

Let us know below, what do you currently do to improve the bank balance when things get tight?