Are you sick and tired of worrying about money, cash flow problems, and the business bank account?

Well you, the small business owner with cash flow problems, are already the government’s number 1 tax target.

Even though you have the worst cash position.

And your bank balance is in a constant race to £0.

Research from JP Morgan Chase shows that small businesses in the Western world have an unhealthy… and dangerous bank balance.

Most are desperate.

And hold a WORRYING LACK OF CASH in reserve.

But there’s a secret blueprint.

In this article, you’re going to learn why you should PUT ON A MASK and lower yourself on a wire like Tom Cruise to STEAL “the secret blueprint”.

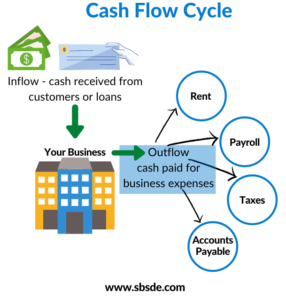

Cash Flow Problems

So the next time you log onto your online banking and check the balance, think about this:

A client of ours made themselves more than £14,000 in one afternoon using ONE of these 4 lessons.

Whilst another saved themselves £1.4 million. Imagine there shock.

They’d gone from feeling the pressure to planning their next holiday…

…With one simple action.

You work so hard, day in, day out… only to keep losing and spending money.

There are business owners all over the country that work longer hours than some of their staff members combined.

Yet they pay themselves next to nothing.

Or sit worrying about money into the night.

And I get it…

…You’re sitting there thinking that everyone’s laughing at you and your cash flow problems.

Because you’re this “successful” business owner that can’t even afford to pay yourself properly.

Have you ever thought to yourself “This has got to stop”

Or…

“I’ve got to do something about this.”

WELL, YOU’RE RIGHT!

And you DO need to do something about this.

If you insist on ignoring the risks that come from dancing with the cash flow devil.

Then here’s what you’ve got to look forward to in your so-called golden years:

-

Unpaid staff members

-

Sleepless nights

-

Angry suppliers

-

Sacrificing your own pay

-

And worrying whether your business will survive.

Even stress in your relationships at home.

You’ll be checking the bank balance when you wake up in cold sweats.

You may even decide to give the business up, hand someone the keys or walk away from it forever.

So if you don’t have a cash buffer of at least 3 months, can you afford to ignore these lessons and put your business at risk?

But when you get this right…

It will change your business so much that anyone in their right mind would be willing to crawl across broken glass on their knees to get your hands on them.

And when you hear these lessons, and USE the strategies inside them, you’ll:

– Find peace

– Sleep easier

– Have a healthier bank balance

– Be able to invest in opportunities that come up

– Pay yourself more

– Pay your team more

– Feel more confident

– Increase the value of your business

– Enjoy your business more

AND make better decisions because you’re in a great state.

So here they are:

The 4 Secret Lessons

Before you read these, get all excited and carry on with your day, I want to make one thing clear.

You HAVE to use them.

So here goes, no more cash flow problems…

The FIRST of the 4 secret lessons to improve cash flow and rid yourself of the problems that come with it…

1. Chase Outstanding Invoices

This guy is something else…

A picture of Simon, a business owner that had some huge cash flow wins

And he’s done something that most business owners ignore.

Or don’t know about in the first place.

It made him ALOT of money.

IN ONE AFTERNOON.

But the coolest part is…

He’s still benefitting from it NOW.

About 18 months ago, this brilliant (and handsome) man named Simon Hogan booked onto one of our events.

It was the finance workshop.

He’s a big one for personal growth.

Always looking for ways to improve and grow his business.

As we started to learn about “the 4 hidden gems in your balance sheet” and how there’s MONEY IN YOUR BUSINESS WAITING TO GET OUT… something in Simon clicked.

He went away that afternoon and checked his accounts receivables (a posh word accountants use for “outstanding invoices”).

He noticed that the amount he was owed was climbing.

And he thought it could be adding to his cash flow problems.

So he dug deeper and found that he had some pretty hefty invoices that were outstanding.

And the people that owed him money were SCHOOLS.

So he got his office manager to ring them.

AND THEY PAID.

The same afternoon.

Here’s the REALLY cool part.

If your accountant has you on an ACCRUAL system, you pay tax when the INVOICE IS RAISED, not when it’s paid.

So if you’ve got outstanding invoices, you’ve ALREADY PAID THE TAX ON THEM.

Collecting them is like being handed TAX-FREE CASH (because you’ve already paid the tax).

That afternoon, which was THE SAME DAY AS THE FINANCE WORKSHOP…

But here’s the other great thing about Simon;

He’s now tracking his accounts receivable (outstanding invoices) religiously.

And he’s still turning up to EVERY workshop and session that we run.

Making himself even more money in the process.

Moral of the story:

Be like Simon and chase your outstanding invoices.

Let’s move on to the second lesson to improve your cash flow.

2. Invoicing Straight Away

You’re sitting at your desk, watching the clock tick by as you wait for the customer to pay your next invoice.

If you’ve not followed step 1…

You know you have outstanding invoices with customers, but you’re not sure when they’ll pay.

The longer you wait, the more your anxiety grows.

Will you be able to pay your own bills on time?

It’s a stressful situation that many small business owners know all too well.

But what if I told you there’s a simple solution?

One that can help improve your cash flow problems and ease your worries? The answer lies within YOUR CONTROL.

The cure:

Invoicing straight away.

Send out invoices as soon as you finish any work you’re doing.

Or as soon as you deliver the product.

That way you’re putting yourself in a better position to get paid faster.

Don’t wait until the end of the month or until you complete a project.

Act fast and send those invoices right away.

Think about it: the longer you wait to invoice, the longer you’ll have to wait for payment.

But if you send out invoices straight away, you’ll increase the chances of getting paid on time.

Your customers will appreciate the promptness too.

Don’t wait any longer than you need to.

Take control of your cash flow by invoicing straight away and get back to focusing on what matters…

…growing your business.

Cash Flow Problems

3. Negotiate With Suppliers

You’ve been up all night, staring at the computer screen, trying to make sense of your finances.

You know you have staff to pay, but your bank account is running low.

You’ve tried everything, but it seems like there’s not enough cash to go around.

What do you do?

The answer may lie in negotiating payment terms with your suppliers.

It may seem like an intimidating task, but it could make all the difference in the world to your cash flow problems.

Ask for extended payment terms.

Or a discount for paying early.

And you could free up some much-needed cash flow to ease your financial worries. But how do you approach your suppliers?

What if they say no?

Don’t worry, negotiating payment terms is a common business practice.

It’s in the interest of your suppliers to keep you as a customer.

Approach the conversation with confidence and explain your situation.

It might surprise you at how willing they are to work with you.

Remember, it’s not about getting something for nothing.

It’s about finding a beneficial arrangement that works for both parties.

So don’t be afraid to speak up and negotiate payment terms with your suppliers.

It could be the key to unlocking the cash flow you need to keep your business going.

Cash Flow Problems In Business

4. Stop Making Emotional Decisions (Especially When They Are Financial Decisions)

Numbers don’t lie, people do.

And why do people usually lie?

EMOTION.

As a business owner, you’re used to making tough decisions.

But what happens when your emotions get in the way?

The decisions that once seemed clear become clouded by doubt and hesitation.

You may find yourself holding onto staff members who are no longer pulling their weight.

And find yourself with even BIGGER cash flow problems.

Or you might stick with suppliers who are no longer meeting your needs.

The truth is, making emotional decisions in your business can be a disaster.

When we let emotions cloud our judgment, people make poor decisions.

They hold onto staff members who are no longer contributing.

It can often be because they feel guilty about letting them go.

You may stick with suppliers who aren’t meeting your needs. Because you don’t want to upset the status quo.

But at what cost?

It can be FATAL.

So how do you stop making emotional decisions in your business?

Start by taking a step back and evaluating the situation.

Gather data… because numbers don’t lie.

Ask yourself, “What’s best for my business?” and make your decision based on facts and data, rather than emotions.

It may be a difficult process, but it’s one that will lead to a more successful and profitable company.

Last year, two competitors were in a battle to win the market share for their business in Manchester.

One of them was a member of our business coaching programme.

The other was a 35-year old company that had served and dominated in the local area.

They were BOTH fighting for the same customers.

And charged the same prices.

Each had between 10 and 15 members of staff.

If you didn’t know better, it would be very hard to tell these two companies apart.

Unless you looked at their bank balance.

6-months after coming out of lockdown, the operations manager moved from one business to the other.

But he was blown away by one major difference.

The way they managed their cash.

They had no cash flow problems.

His old company, the 35-year old business that had dominated for decades, was struggling.

They often had cash flow problems with:

-

Choosing which supplier they were going to pay that month

-

Ringing HMRC to organise VAT payment plans

-

Paying staff late

-

And the directors of the business often complained that they had sacrificed their salaries.

When he joined our client’s business, he was gobsmacked.

They were always paid on time.

And had a fantastic system in place to chase outstanding invoices if any fell through the cracks.

They paid ALL the staff EVERY month,

And the owners of the business even organised regular team day’s out if they all hit target.

But the best part?

At the end of each year, the owners gave everyone a Christmas bonus.

They were only supposed to pay it if the business hit its cash goal. The staff considered that a foregone conclusion.

After 9 months, 6 members of staff from his old workplace approached him for a new job.

They ALL wanted to join our client’s company.

They were stressed.

There was a lot of pressure.

And to make matters worse, there were rumours that the old business was going into liquidation.

Which it eventually did.

He said the staff had seen the business owner at his worst.

So overcome with frustration that he leant against the closed door of his office and screamed at the top of his lungs.

Summary

Please…

…pay attention to your CASH and the PROFIT.

Then action the 4 cash flow lessons mentioned above.

Because if you do, your business can feel VERY different.

Like it did for BOTH of the clients we mentioned that have control over their cash.

But here’s a word of warning.

You will only do this if:

– You’re an action taker

– You’re the kind of person that does what they said they were going to do

– You believe you can actually improve the CASH POSITION of your business.

And if you want to learn more about improving your cash flow or how to read a balance sheet, all you have to do is click here to visit our learning centre.